Testimonials

Take advantage of this offer while you can. Save up to £750 by letting us pay for your conveyancing selling fees when your property sale completes.

This offer is for a limited time only so please call and ask for full terms and conditions.

Let Myler Estates sell your home and we will pay your solicitors selling feeFor most Widnes people, a mortgage is the only way to buy a property. However, for some, especially Widnes homeowners who have paid off their mortgage or Widnes buy to let landlords, many have the choice to pay exclusively with cash. So the question is, should you use all your cash, or could a mortgage be a more suitable option?

Well, looking at the numbers locally…

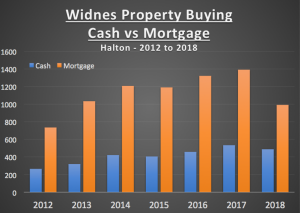

2,893 of the 10,761 property sales in the last 7 years in Halton were made without a mortgage (i.e. 26.9%)

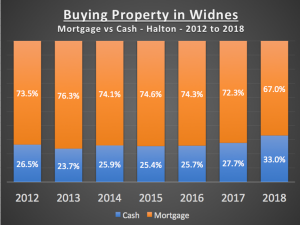

Interesting when compared with the national average of 31.9% cash purchases over the last seven years. Next, I wanted to see that cash percentage figure split down by years. As you can see from the graph, this level of cash purchases vs mortgage purchases has remained reasonably constant over those seven years…

Next, if you are going to go for a mortgage, the next question has to be whether you should fix the rate or have a variable rate mortgage. In the last Quarter, 90.57% of people that took out a mortgage, had a fixed rate mortgage at an average interest rate of 2.27%, although what did surprise me was only 65.79% of the £1.429 trillion mortgages outstanding in the whole of the UK were on a fixed rate. The level of mortgage debt compared to the value of the home itself (referred to as the Loan to Value rate – LTV) was interesting, as 61.9% of people with a mortgage have a LTV of less than 75%. Although, one number that did jump out at me was only4.33% of mortgages are 90% and higher LTV – meaning if we do have another property slump, the number of people in negative equity will be relatively small.

Next, looking at the actual number of properties sold, it can be clearly seen the number of house sales has dipped slightly in 2018…

So those are the numbers … let us have a look at the pros and cons of taking a mortgage, with specific focus on Widnes buy to let landlords.

Taking a mortgage will help a landlord increase their investment across more properties to maximise the return, rather than putting everything into one Widnes buy to let property. This will enable the landlord to ensure if there a void in the tenancy, there should still be rent coming from the other properties. The flip side of the coin is that there is a mortgage to pay for, whether or not the property is let.

The other great motivation of taking a mortgage is that landlords can set the mortgage interest against the rental income, although that will only be at the basic rate of tax by 2021 due the recent tax changes. Banks and Building Societies will characteristically want at least a 25% deposit (meaning Widnes landlords can only borrow up to 75%) and will assess the borrowing level based on the rental income covering the mortgage interest by a definite margin of 125%.

A lot will depend on what you, as a Widnes landlord, hope to attain from your buy to let investment and how relaxed you would feel in making the mortgage payments when there is a void (interestingly, Direct Line calculated a few months ago that voids cost UK landlords around £3bn a year or an average of £1000 per property per year). You also have to consider that interest rates could also increase, which would eat into your profit … although that can be mitigated with fixing your interest rate (as discussed above).

So, with everything that is happening in the world, does it make sense to buy rental properties? Now we help many newbie and existing landlords work out their budgets, taking into account other costs such as agent’s fees, finance, maintenance and voids in tenancy. The bottom line is we as a country aren’t building enough property, so demand will always outstrip supply in the medium to long term, meaning property values will keep rising in the medium to long term. That’s not to say property values might fall back in the short term, like they did in 2009 Credit Crunch, the 1988 Dual MIRAS crash, the recession of the early 1980’s, the 1974 Oil Crisis, the early 1930’s Great Depression … yet every time they have bounced back with vigour. Therefore, it makes sense to focus on getting the best property that will have continuing appeal and strong tenant demand and to conclude, buy to let should be tackled as a medium to long term investment … because the wisest landlords see buy to let investment in terms of decades – not years.

26.9% of All Widnes Properties were Bought Without a Mortgage in the Last 7 YearsWith constant advances in technology, medicine and lifestyles, people in the Widnes area are, on average, living longer than they might have a few decades ago. As Widnes’ population ages, the problem of how the older generation are accommodated is starting to emerge. We, as a town, have to consider how we supply decent and appropriate accommodation for Widnes’ growing older generation’s accommodation needs while still offering a lifestyle that is both modern and desirable.

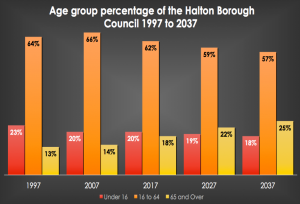

In 1997 in Widnes, around one in every eight people (13%) were aged 65 years and over (and the local authority area as a whole), increasing to nearly one in every five people (18%) in 2017 and it is projected to reach one in every four people (25%) by 2037, meaning..

Over the next 19 years, the growth of the over 65 population in Widnes will grow by 38.9% – a lot more than the overall growth population of Widnes of 2.1% over the same time frame.

In fact, the number of those over 90 is expected to more than double in our local authority from 790 (0.6%) in 2017 to 1,836 (1.4%) by 2037.

And looking at the proportional percentage changes over those years…

Age group percentage of the Halton Borough Council – 1997 to 2017 and 2017 to 2037

| Percentage Change from 1997 to 2017 | Percentage Change from 2017 to 2037 | |

|---|---|---|

| Under 16 | -13.04% | -10.00% |

| 16 to 64 | -3.13% | -8.06% |

| 65 and Over | 38.46% | 38.89% |

Looking at Widnes and the local authority as a whole, there is a distinct under supply of bungalows and retirement living (i.e. sheltered) accommodation. The majority of sheltered accommodation fit for retirement is in the ex-local authority sector whilst the majority of private sector bungalows were built in the 1960s/70s/80s and are beginning to show their age (although that means there is often an opportunity for Widnes investors and Widnes buy to let landlords to buy a tired bungalow, do it up and flip it/rent it out).

In the medium to longer term, we need to build more bungalows and sheltered accommodation and, if we do that, that won’t only be of benefit to the elderly population of Widnes – it will have a direct knock-on effect to the younger and middle-aged population by unlocking those family homes the older generation homeowners live in.

There have been 17 Housing Ministers since 1997. No one ever seems to stay in the job long enough to create a consensus and direction in Government Policy on the vital issue of the country’s housing shortage, yet the sound bites and White Papers seem only to focus exclusively on first-time buyers when there is an even more severe and disregarded shortage in suitable housing for the older generation.

This scantiness affects both mature homeowners trapped in unsuitably big family properties, unable to find smaller bungalows or suitable retirement apartments, whilst the waiting list for Council sheltered accommodation is putting a strain on other aspects of social care. In both circumstances, policy coming (or not coming) out of Government is repressing the supply and type of accommodation mature people desire, need and want, whilst at the same time, increasing the cost (and taxes) for social and NHS care.

Maybe we need tax breaks for people to downsize or planning permissions that stipulate bungalows only. Whichever way you look .. there are challenging times ahead for us all.

As OAP’s set to rise to 1 in 4 of Widnes’ population by 2037 – Where are they all going to live?